A recent press release from DataQuick provides some noteworthy stats on Phoenix Metro home sales. While the whole piece is worth reading, highlights of the DataQuick Report include:

- >Total sales (new and resale for condos and houses) increased 4.9% in May year over year.

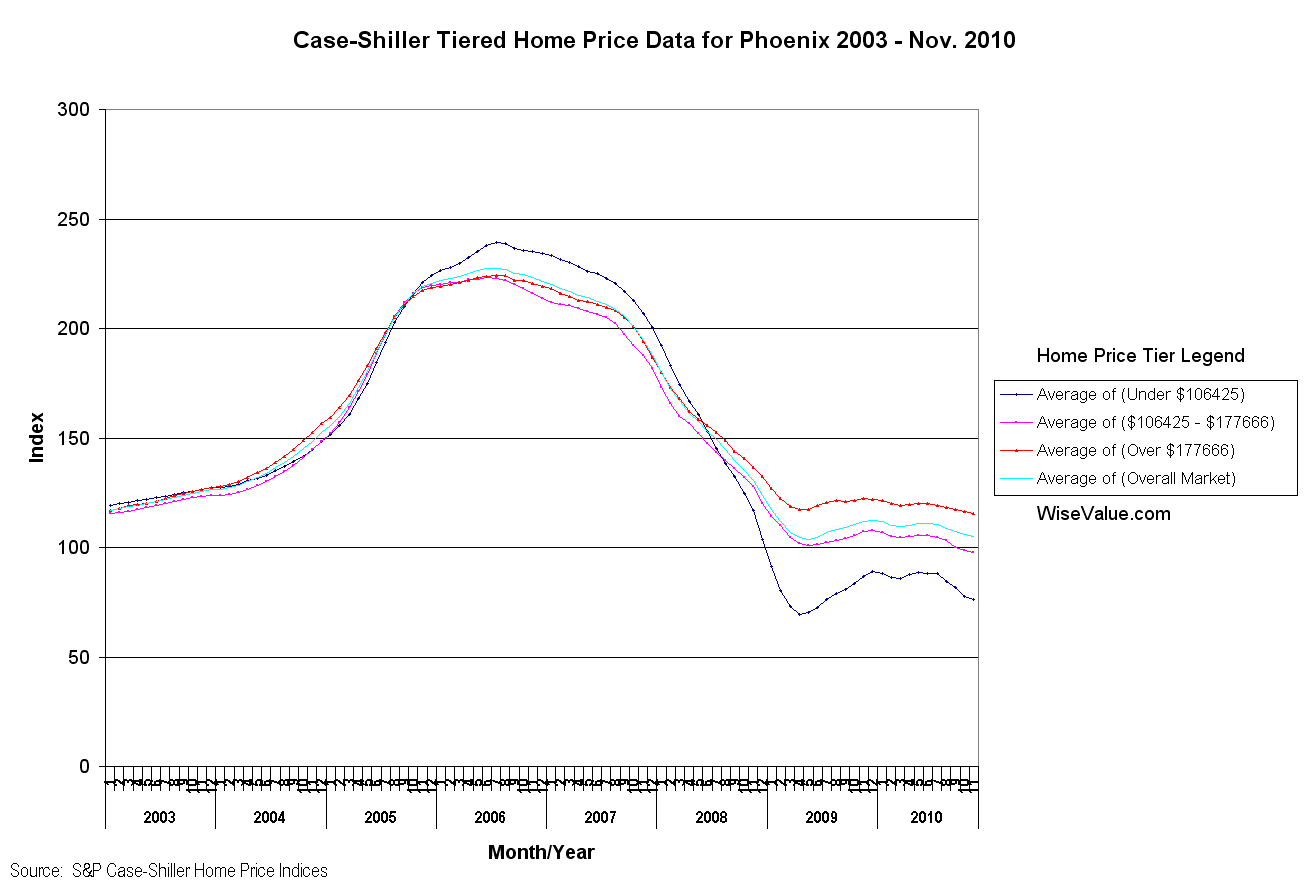

- >Homes under $100,000 accounted for 39.7% of all May sales.

- >May 2011 demand for residential construction fell to 6.8% from 10.1% of all sales year over year — a greater than 30% drop for an already decimated sector.

- >FHA was used to finance 35.5% of all sales in May — down from 46.4% for May 2010.

- >Cash buyers increased from 34.4% last May to 42% of all sales for May 2011.

- >Absentee buyers (which could be an investor or second home buyer) increased year over year for the month of May from 37.8% to 45.3% of all sales.

- >64% of sales were either sales of foreclosed homes or short sales.

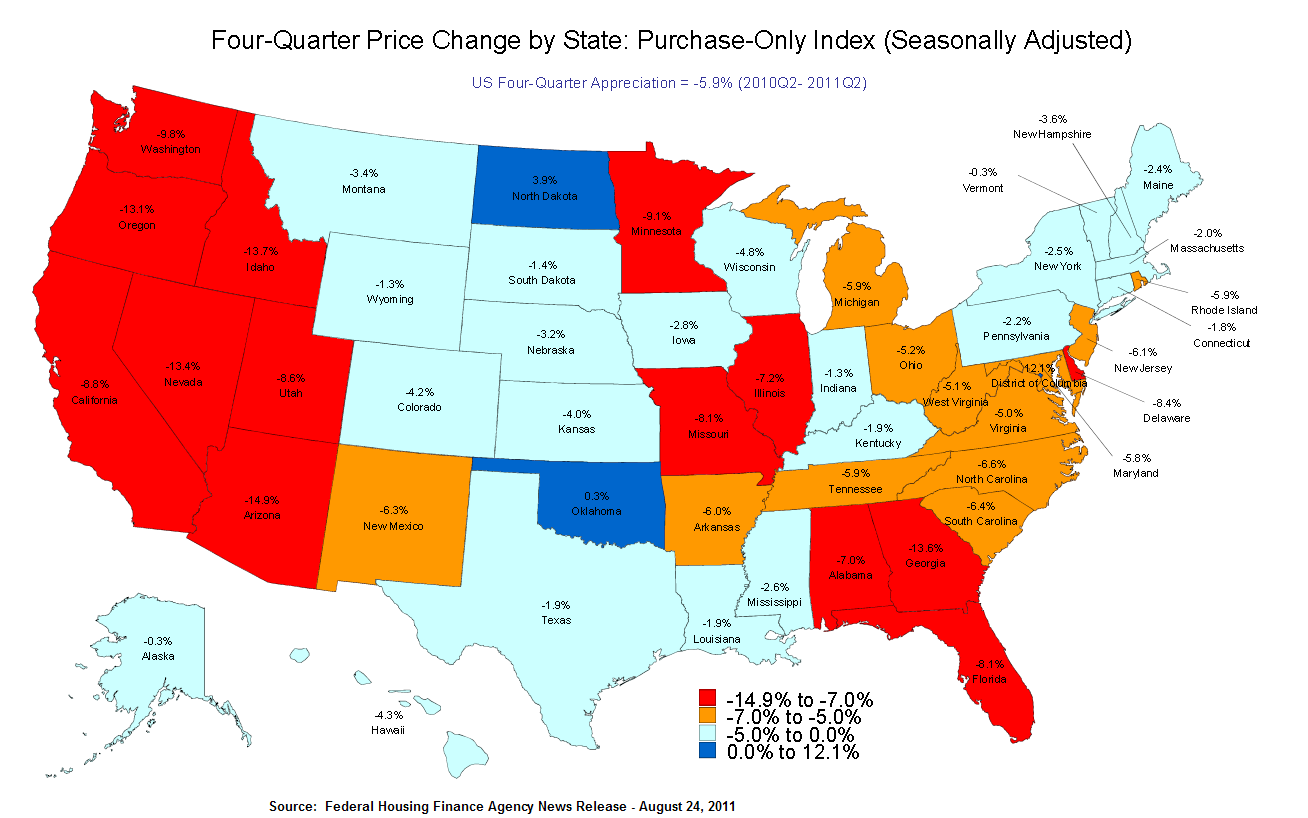

- >The median price of resale houses fell 13% year over year, while resale condos for the same time period fell 18.4%.

Wisevalue.com conclusion: The increase in total sales and cash buyers are a positive sign for price stabilization. However, the level of distressed sales and conversion from owner-occupied to rental properties, coupled with the potential wave of foreclosure inventory we covered here; translates into a long and arduous journey to find stable prices and eventually…..someday…..appreciation.