Short Sale & Foreclosure Stats

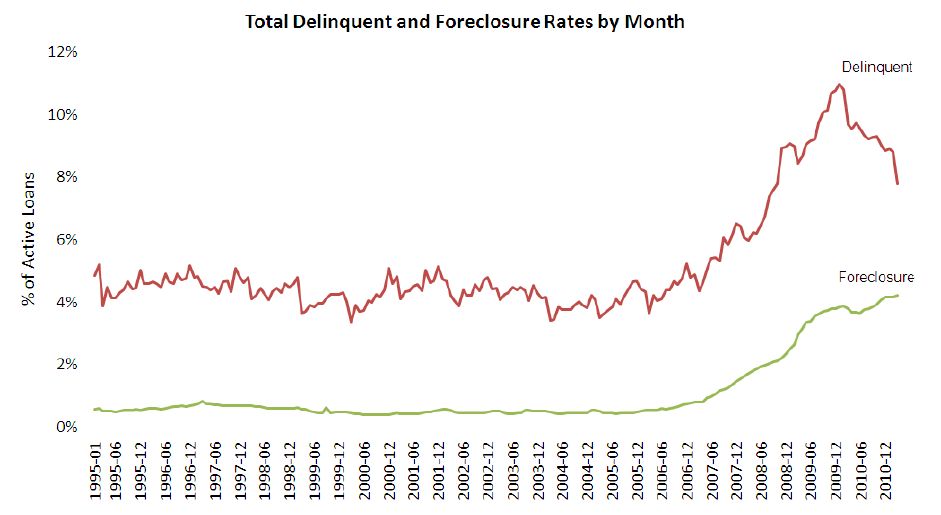

Election day 2012, Calculated Risk posted an updated Table of Short Sales and Foreclosures from Selected Cities from economist Tom Lawler. Our data confirms positive trends in the Phoenix area. With nearly 40% of sales categorized as “Distressed” in Phoenix, the market needs momentum to keep clearing distressed properties from inventory.

Comments Off